Institutions and "whales" have continued their bitcoin purchases, on-chain data shows.

Table of contents

- Bitcoin is breaking records because bigger investors are buying it now, says PwC

- Publicly traded companies

- Fed Commits to Keep Buying at Least $120 Billion of Bonds Each Month

- Bitcoin: Will The Arrival Of Institutional Money Cause A New Price Surge?

- Bitcoin: Will The Arrival Of Institutional Money Cause A New Price Surge?

And MicroStrategy is looking to get other companies invested in Bitcoin; in February , it hosted a Bitcoin for Corporations strand during its World. Now conference , aimed at getting companies up to speed with the crypto asset.

Bitcoin is breaking records because bigger investors are buying it now, says PwC

During the conference, Saylor stated that he anticipated an "avalanche of companies" converting their balance sheets into Bitcoin in the coming year. Speaking at Binance Blockchain Week, Saylor explained why he'd opted for Bitcoin over gold as a reserve asset. The investment amounts to around 7. More like 7. Tesla had According to the SEC filing, Tesla's Bitcoin purchase reflects an updated investment policy aimed at diversifying its cash on hand and maximizing returns.

Publicly traded companies

The filing states that, "we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future. Tesla also revealed that it expects to begin accepting Bitcoin as payment for its products "in the near future," leaving open the question of whether it will liquidate or continue to hold the cryptocurrency upon receipt of payment.

- Are Institutional Investors Not Buying Bitcoin Anymore? | Coin Insider!

- OTC Market and Effect on Bitcoin Exchange Market!

- More Institutional Investors Jumping Into Bitcoin Leaves Less to Go Around, Data Shows.

- gagner des bitcoins rapidement.

- bitcoin descending triangle.

- Institutional Investors Are Piling into Bitcoin | ETF Trends.

Soon afterwards, at the end of January , Musk changed his Twitter bio to the Bitcoin hashtag; in retrospect, seemingly hinting at Tesla's interest in the cryptocurrency. Founded by Michael Novogratz in January , the company has partnered with crypto firms including Block. Novogratz is, unsurprisingly, a keen advocate for Bitcoin.

In April , he noted that stimulus measures announced in response to the coronavirus pandemic were driving interest in cryptocurrencies , calling it Bitcoin's "moment" and arguing that "money doesn't grow on trees.

However, later in the year Novogratz argued that the cryptocurrency's volatility meant that gold was a safer bet , stating that, "My sense is that Bitcoin way outperforms gold, but I would tell people to hold a lot less than they do gold. Just because of the volatility.

Fed Commits to Keep Buying at Least $120 Billion of Bonds Each Month

These investment funds don't hold Bitcoin on their own behalf, instead doing so in order to enable accredited investors to gain exposure to Bitcoin without holding or managing the cryptoasset directly. Grayscale Investments is undoubtedly one of the biggest names in the Bitcoin space—and for good reason.

Copper, meanwhile, has now advanced for seven straight weeks and is trading at its highest price in close to eight years.

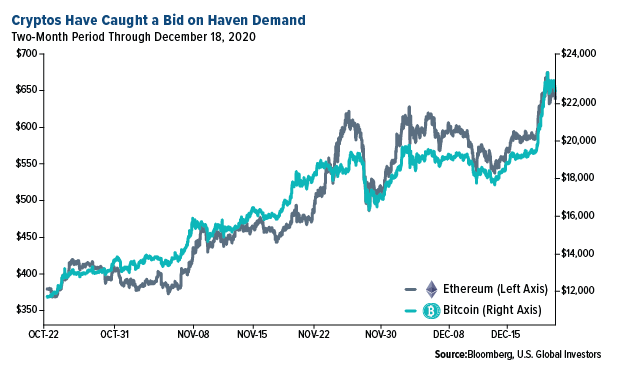

But unlike then, the current run-up is driven not just by retail investors but also big-name investors, institutions, hedge funds and more. Speaking to Bloomberg on Wednesday, Minerd said he believes Bitcoin should be worth—are you sitting down? Crypto miners and blockchain firms have likewise done well this year. Keep in mind that cryptos is still extremely volatile. Soon there may be another way for investors to participate in cryptocurrencies besides buying them outright or investing in miners like HIVE.

Bitcoin: Will The Arrival Of Institutional Money Cause A New Price Surge?

Robinhood, the six-year-old trading app favored by younger, less experienced investors, is eyeing the first quarter of as a potential IPO target. After stocks collapsed in March and April of this year, the number of people who downloaded and started using Robinhood surged to 13 million, up from 2 million three years earlier. These millennial investors beat Warren Buffett at his own game, buying up distressed airline stocks at a time when the Berkshire Hathaway chief was selling.

Three of the 10 biggest U. These have been monster deals that demonstrate just how valuable intangibles really are. Take a look at Airbnb. The company, which does not own any hotels or properties of its own, now has a higher valuation than the combined market caps of Marriott, Hyatt and Hilton combined. As others have pointed out, this trend of valuing intangibles ahead of tangibles is only accelerating.

He said a lot more people today have accounts on crypto exchanges than before as buying cryptocurrencies is easier now than before.

Bitcoin: Will The Arrival Of Institutional Money Cause A New Price Surge?

There's a lot of optimism in the crypto markets as well," he said. But crypto fans say the current rally is different as it is driven by institutional buying rather than retail speculation. For his part, Arslanian said one big difference between this rally and the one seen in is clarity in regulations, which was scarce back then.

Today, he said, most regulators around the world have people working on crypto internally. Many of the large financial centers have "pretty good regulatory clarity on crypto markets and that is giving comfort, not only to institutional investors but also retail investors as well coming in the market," he said.

While Arslanian declined to put a price target on bitcoin for this year, he said the current momentum remains optimistic. Skip Navigation.