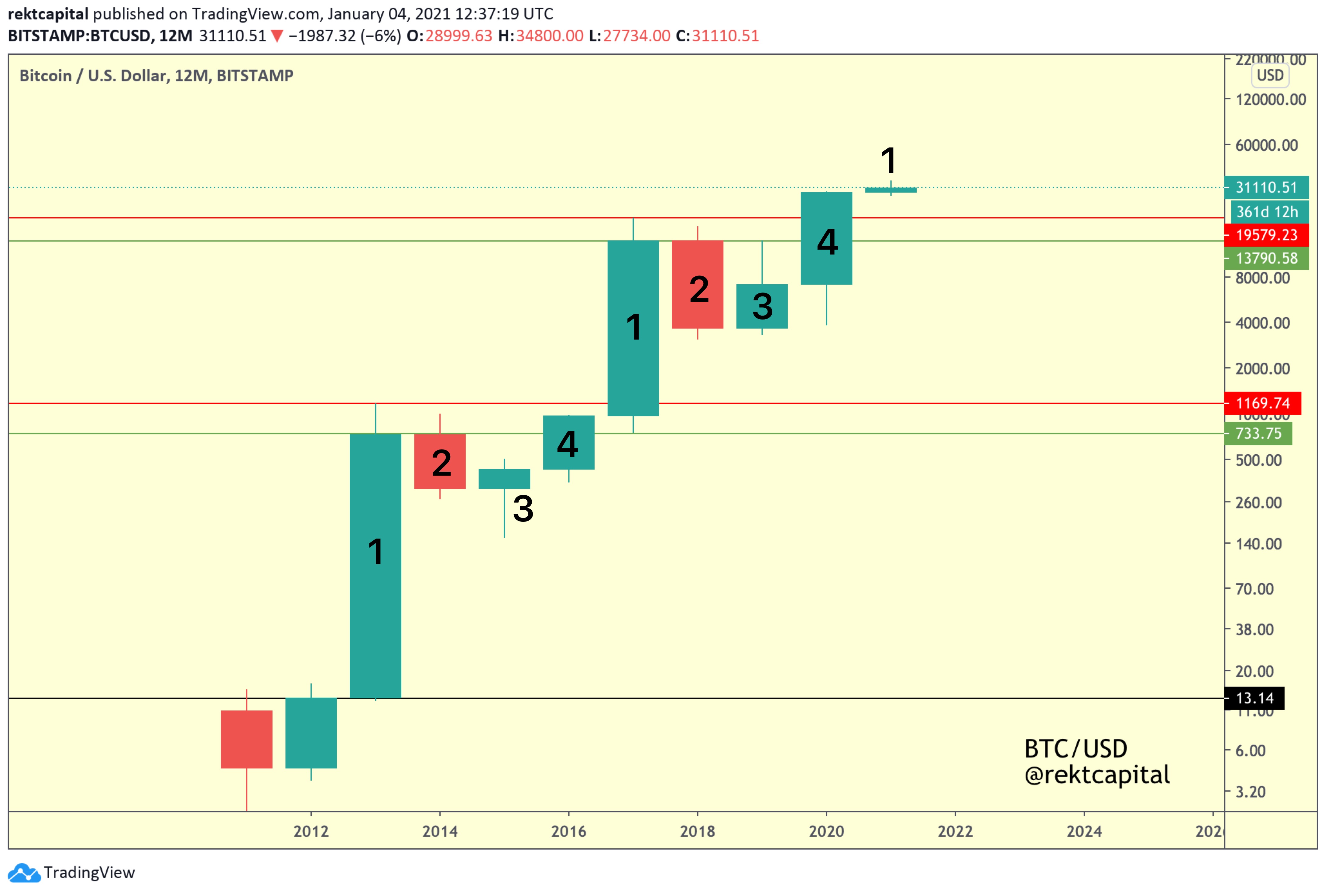

Bitcoin tends to form Four Year Cycles. In its first year of the cycle, exponential growth occurs. In the second year - a Bear Market takes place.

Table of contents

Despite their heavy reliance on data, investors can be an emotional lot—they are susceptible to the same biases as everyone else, after all. Financial services companies Mastercard and BNY Mellon have announced new Bitcoin initiatives, helping it top this notable threshold. For regular investors, that means you should tread lightly with this speculative asset class unless you have your fundamentals, like an emergency fund and basic retirement portfolio , covered.

BNY Mellon, which can trace its roots back to the 18th century, is the latest big name to adapt to the world of Bitcoin. The financial services giant plans to help its asset-management customers utilize Bitcoin, essentially treating it like any other security. This alternative reserve will also look into gold bullion, gold exchange traded funds ETFs , and potentially other assets in the future.

The irony is that speculation could undermine the interests of Tesla and Mastercard in using Bitcoin as a medium of exchange. Why use Bitcoin to buy goods and services when its value fluctuates double-digits on a regular basis? As Covid spread to Europe and then the United States, starting in late February, governments began imposing lockdowns to limit the spread of the virus. Lockdowns suppressed economic growth, sparking a global recession , and central banks stepped in to support national economies.

In the U. As the economy began to heal, Fed Chair Jerome Powell announced that the Fed would allow inflation to run a bit higher before the FOMC would contemplate raising interest rates again. The new strategy crystallized new thinking and new research at the Fed concerning weak inflation.

- Download ET App:.

- lolli bitcoin?

- best ios bitcoin faucet.

- bitcoin market future.

- bitcoin atm cardiff.

Enter Paul Tudor Jones and other hedge fund heavies , who began buying up Bitcoin in May in anticipation of rising inflation. In October , online payments giant PayPal announced it would let customers buy, hold and sell a range of cryptocurrencies, including Bitcoin, as well as allow them to actually make purchases with Bitcoin at more than 26 million businesses. Fidelity, one of the few mainline Wall Street firms to fully embrace Bitcoin, has created a separate unit—Fidelity Digital Assets—to manage this fund and similar vehicles.

These developments confirm a growing trend of regulatory and institutional acceptance of cryptocurrencies. So where do we go from here? The real story is more complicated, according to Campbell Harvey, Duke professor and senior advisor to Research Affiliates.

- binance support hard fork bitcoin cash.

- Bitcoin Halving.

- Bitcoin - The Four Year Cycle.

- bitcoin purchase shares.

- motley fool canada bitcoin.

Over a time frame of hundreds of years , gold may retain its value. The German company said that following a far-reaching legal investigation it had concluded Winterkorn and Stadler had breached their duty of care, adding it had found no violations by other members of the management board. Winterkorn and Stadler have both denied being responsible for the scandal.

After two days of sell-offs, bitcoin bulls finally returned. The stock market debut followed strong investor enthusiasm for Poshmark Inc. The British pound rallied on Friday to break above the 1. However, the 50 day EMA looks as if it is trying to offer resistance. But on Monday, when Abu Dhabi begins selling futures contracts for its oil and then shipping the barrels from Fujairah, it will mark an aggressive shift by the emirate.

Investors globally are clamoring for commodities because of their high yields relative to other assets and to protect themselves against any rise in inflation. Creating a new benchmark will hardly be easy. Oil traders dislike change, especially when they believe markets already do a good job matching supply and demand.

It was forced to shelve the plan indefinitely. Enter GoldmanMurban will also face competition regionally. Platts publishes price assessments for Dubai oil and the Dubai Mercantile Exchange trades futures for Omani crude. Both act as benchmarks for Middle Eastern shipments to Asia. Yet Abu Dhabi says the combination of high supply, easy access to oil-consuming markets from Fujairah and the absence of trading restrictions will attract plenty of buyers to its exchange.

The futures platform will be run by Atlanta-based Intercontinental Exchange Inc. The Murban exchange and the capacity boost could raise tension within the Organization of Petroleum Exporting Countries, according to Hari of Vanda Insights. The Gulf states dominate the cartel and tend to prize unity.

Bitcoin - Wikipedia

They also began unprecedented production cuts last year to bolster prices as the coronavirus pandemic spread. The unregistered stock offerings were said to be managed by banks including Goldman Sachs Group Inc. The liquidation triggered price swings for every stock involved in the high-volume transactions, while rattling some of their industry counterparts.

It also spurred speculation among some traders of forced selling by a fund being liquidated. Goldman Sachs did not respond to a requests seeking comment. Among the affected stocks were Chinese giants such as Baidu Inc. In block trades, large volumes of securities are privately negotiated between parties, usually outside of open market. Crachilov discusses Nickel Digital Asset Management and its sharded key management solution they use for clients. He explains their use of more efficient perpetual swaps that settle every 8 hours as opposed to traditional futures that settle monthly.

Crachilov says that is the year that Bitcoin went institutional and that, even though we are near all-time highs, his indicators show that there appears to be much more growth to come. Filmed on January 15, Key Learnings: Institutions need the highest level of custody security, requiring no single point of failure, and Nickel Digital Asset Management has created a sharded key management solution for this. Perpetual swaps are a more efficient type of futures contract than traditional futures—as a result, perpetual swaps are becoming widely used in crypto.

Even after Bitcoin has reached new all time highs recently, the indicators Crachilov uses based on the Bitcoin halving show that institutions are allocating for long-term growth, and not on short term speculation, which provides investors more opportunity for upside in the near term. Prior to founding Morgan Creek, Mr. Yusko has been at the forefront of institutional investing throughout his career. An early investor in alternative asset classes at Notre Dame, he brought the Endowment Model of investing to UNC, which contributed to significant performance gains for the Endowment.

Yusko is again at the forefront of investing through Morgan Creek Digital Assets, which was formed in Saylor is a technologist, entrepreneur, business executive, philanthropist, and best-selling author. Since co-founding the company at the age of 24, Mr. Saylor has built MicroStrategy into a global leader in business intelligence, mobile software, and cloud-based services.

Saylor attended the Massachusetts Institute of Technology, receiving an S. He is a reputed crypto asset specialist and blockchain thought leader focused on helping people find innovative ways to participate in this space. He is active in the blockchain community with speaking engagements, TV appearances and mentoring. James has over 15 years of experience in the Fintech industry. Real Vision members also have access to Real Vision Crypto, a cryptocurrency and digital assets video channel watched by over 80, people. In addition, Raoul has been publishing Global Macro Investor since January to provide original, high quality, quantifiable and easily readable research for the global macro investment community hedge funds, family offices, pension funds and sovereign wealth funds.

What is cryptocurrency?

It draws on his considerable 31 years of experience in advising hedge funds and managing a global macro hedge fund. Global Macro Investor has one of the very best, proven track records of any newsletter in the industry, producing extremely positive returns in eight out of the last twelve years. He retired from managing client money at the age of 36 in and now lives in the tiny Caribbean island of Little Cayman in the Cayman Islands. Other stop-off points on the way were NatWest Markets and HSBC, although he began his career by training traders in technical analysis.

Peter created and hosts the What Bitcoin Did Podcast, a twice-weekly Bitcoin podcast where he interviews experts in the world of Bitcoin development, privacy, investment and adoption. Launched in November of , the podcast has grown to over episodes with a guest list that is a testament to the diversity of knowledge and opinions that represent the broader Bitcoin community. Expanding his growing list of human interest recordings, documentaries and films Peter has recently launched the Defiance podcast and DefianceTV. FFTT caters to institutions and sophisticated individuals by aggregating a wide variety of macroeconomic, thematic and sector trends in an unconventional manner to identify investable developing economic bottlenecks for his clients.

Phase 1 — Exponential Highs

Prior to that, Luke was a partner at Midwest Research, where he worked in equity research and sales from He earned the CFA designation in Meltem Demirors is Chief Strategy Officer of CoinShares, an investment firm that manages billions in assets on behalf of a global investor base, and is a trusted partner to investors and entrepreneurs navigating the digital asset ecosystem. Previously, she was part of the founding team of Digital Currency Group.

As a veteran investor in the digital currency space, she has invested in over companies in the ecosystem. Skip to content.

Bitcoin - the 4 year cycle

Published on January 21st, Duration 58 minutes. The Interview - Crypto.

Piers Kicks: Earning Money in the Metaverse. Bitcoin: Savior of a Dying Empire?