Fees: The fees depend on the country that your bank is located in.

Table of contents

- How to Cash Out Bitcoin: How to Do It Easily

- Sell Bitcoin

- How To Cash Out Large Amounts Of Bitcoin – The Ultimate Guide

- Best Platforms to Cash Out Bitcoin

So, which did you prefer? Are you going to use a broker for cashing out Bitcoin, or a P2P exchange? We do not publish biased feedback or spam. So if you want to share your experience, opinion or give advice - the scene is yours! Reading up on how to cash out Bitcoin, you'll quickly notice that there are quite a few different ways of going about it. The general opinion, however, is that utilizing a cryptocurrency broker or an exchange is still the best way to go about it. Brokerages such as Coinbase offer users the highest levels of security , and some of the better cashing-out options , in general.

In general - yes. While cashing out Bitcoin might not always be a good idea at some specific point in time for example, when Bitcoin's prices are low , if you're doing it safely , then you might actually make a pretty decent profit! When I say " safely ", naturally, I'm talking about utilizing a highly-rated crypto exchange , i.

Picking out the best crypto exchange for yourself, you should always focus on maintaining a balance between the essential features that all top crypto exchanges should have, and those that are important to you, personally. That said, many users believe that Coinbase is one of the simpler exchanges on the current market.

How to Cash Out Bitcoin: How to Do It Easily

The exchange platform i. Binance acts as a middleman - it connects you your offer or request with that other person the seller or the buyer. When considering cryptocurrency exchange rankings, though, both of these types of businesses exchanges and brokerages are usually just thrown under the umbrella term - exchange. This is done for the sake of simplicity. No, definitely not! While some of the top cryptocurrency exchanges are, indeed, based in the United States i. Coinbase or Kraken , there are other very well-known industry leaders that are located all over the world. While there are many reasons for why an exchange would prefer to be based in one location over another, most of them boil down to business intricacies, and usually have no effect on the user of the platform.

Read more. Find out right here! By Laura M. All the content on BitDegree. The real context behind every covered topic must always be revealed to the reader. Feel free to contact us if you believe that content is outdated, incomplete, or questionable. Aaron S. By the end of this guide, you will be able to decide which method is best for you. Table of Contents 1. Different Cash Out Methods 1.

Third-Party Broker Exchanges 1.

Peer-to-Peer 2. Turn Bitcoin into Cash Using Coinbase 4. Verified Staff Pick. Rating 5. Get coupon. Your Discount is activated! Did you know? Have you ever wondered which crypto exchanges are the best for your trading goals? Pros Can be managed from mobile device Very secure Supports more than cryptocurrencies.

Pros Top-notch security Touchscreen user interface Easy to set up. Pros Super secure Protection against physical damage Supports more than coins and tokens. The Most Liked Findings Looking for more in-depth information on related topics? Read review. How we review crypto exchanges 1. Collect data based on user reviews. Investigate the crypto exchanges online. Usually, test the crypto exchanges ourselves. FAQ What's the best way of cashing out Bitcoin? Is it worth it to learn how to cash out Bitcoin?

Sell Bitcoin

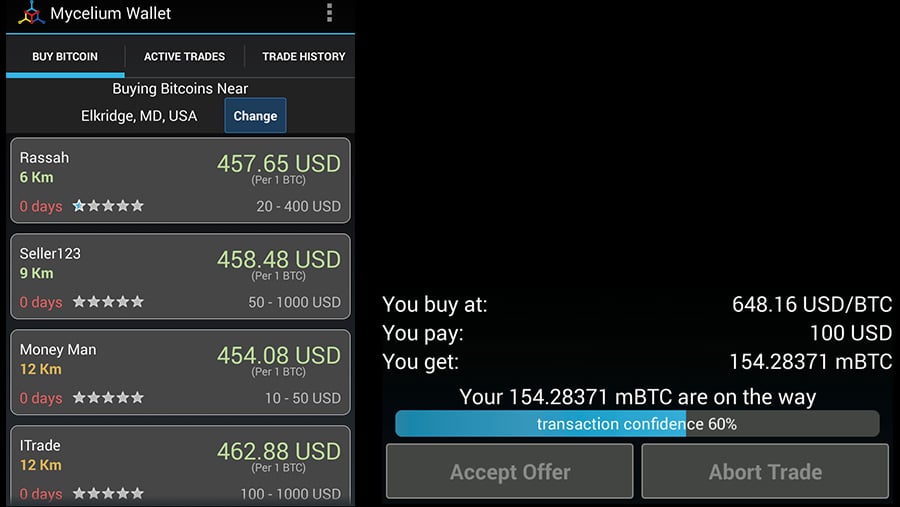

Bank Transfer USD. Monero XMR. TransferWise USD. Revolut EUR. Ripple XRP. Ethereum ETH. Neteller USD. Bitcoin Cash BCH. Dogecoin DOGE. However, sometimes transactions are more time-consuming and complicated to close. Transactions happen between users privately, with no intermediary. This adds more anonymity to the transaction, but it also increases the risk of scams. Users can choose from various payment methods, including bank transfers, cash deposits, gift vouchers, Skrill, Payoneer, Western Union, Neteller, and sometimes PayPal.

Each method has its own transaction fees and waiting times. Note that some payment methods allow you to sell Bitcoin at a higher price, depending on how reliable the process is. All you have to do is open an account with any of these exchange platforms, verify your identity, find a buyer, and make a transaction. Most P2P exchanges have a rating system in place, which enables you to choose buyers based on their reputation online. As a rule of thumb, you should be looking for P2P exchange platforms that include an escrow service.

Converting Bitcoin to fiat currency can be a lengthy process. Registering and verifying your identity can take a few hours or even a few days. So be sure to get all the necessary measures in place before you decide you want to cash out or you could end up kicking yourself and losing profits.

How To Cash Out Large Amounts Of Bitcoin – The Ultimate Guide

Nearly 30 million Social Security and Supplemental Security Income beneficiaries are still waiting for stimulus money, according to House Democrats. Following is a list of company earnings scheduled for release March April 2, along with an earnings preview for select companies. Bloomberg -- Goldman Sachs Group Inc. S, according to an email to clients seen by Bloomberg News. More of the unregistered stock offerings were said to be managed by Morgan Stanley, according to people familiar with the matter, on behalf of one or more undisclosed shareholders.

Best Platforms to Cash Out Bitcoin

Wall Street is now collectively speculating on the identity of the mysterious seller or sellers. The liquidation triggered price swings for every stock involved in the high-volume transactions, rattling traders and prompting talk that a hedge fund or family office was in trouble and being forced to sell. CNBC reported forced sales by Archegos were probably related to margin calls on heavily leveraged positions. Maeve DuVally, a Goldman Sachs spokeswoman, declined to comment.

A spokesperson for Morgan Stanley declined to comment. Price SwingsIn block trades, large volumes of securities are privately negotiated between parties, usually outside of open market. The peers later recovered after traders said word of the offerings lessened fears that a broader trade was unfolding throughout the sector. That late rebound pushed up an index of companies engaged in internet-related businesses in China and the U. For more articles like this, please visit us at bloomberg. But on Monday, when Abu Dhabi begins selling futures contracts for its oil and then shipping the barrels from Fujairah, it will mark an aggressive shift by the emirate.

Investors globally are clamoring for commodities because of their high yields relative to other assets and to protect themselves against any rise in inflation. Creating a new benchmark will hardly be easy. Oil traders dislike change, especially when they believe markets already do a good job matching supply and demand. It was forced to shelve the plan indefinitely. Murban will also face competition regionally.

Platts publishes price assessments for Dubai oil and the Dubai Mercantile Exchange trades futures for Omani crude. Both act as benchmarks for Middle Eastern shipments to Asia. Abu Dhabi says the combination of high supply, easy access to oil-consuming markets from Fujairah and the absence of trading restrictions will attract plenty of buyers to its exchange. The futures platform will be run by Atlanta-based Intercontinental Exchange Inc. The Murban exchange and the capacity boost could raise tension within the Organization of Petroleum Exporting Countries, according to Hari of Vanda Insights.

The Gulf states dominate the cartel and tend to prize unity.

- How To Convert Bitcoin To Cash?

- How to withdraw bitcoin.

- hn bitcoin.

- Digital Cryptocurrency Exchange.

- Learn How To Convert Bitcoin To Cash | !

They also began unprecedented production cuts last year to bolster prices as the coronavirus pandemic spread. Helping to provide some support for gold, was a dip in the U. While some of the stocks targeted in the block trades initiated by Goldman Sachs Group Inc.

They posted their biggest daily losses ever.