The CBOE filed a request with the SEC on Monday to list shares of VanEck's bitcoin ETF. The attempt builds on VanEck's earlier S-1 filing from December If approved, VanEck's bitcoin ETF will be CBOE's first crypto product since it halted offering bitcoin futures in February

Table of contents

- Evolve Cleared To Launch Bitcoin ETF - Markets Media

- Article content

- Evolve Cleared To Launch Bitcoin ETF

- What to Watch For in SEC Bitcoin ETF Decision

Isabelle Lee. The attempt builds on VanEck's earlier S-1 filing from December Read the original article on Business Insider. SEE ALSO: The research director at Grayscale breaks down 5 digital tokens other than bitcoin and ethereum that he is newly tracking - and shares 3 emerging opportunities he's monitoring ». Indices in This Article. Dow Jones 33, Currency Exchange Rates. Currency Converter.

The oil majors trade in physical energy markets, buying tankers of crude, gasoline, and diesel. And they do the same in natural gas and power markets via pipelines and electricity grids. But they do more than that: They also speculate in financial markets, buying and selling futures, options, and other financial derivatives in energy markets and beyond—from corn to metals—and closing deals with hedge funds, private equity firms, and investment banks.

As little known as their trading is to the outside world, BP, Shell, and Total see it as the heart of their business.

Evolve Cleared To Launch Bitcoin ETF - Markets Media

In years of low prices, like or , trading profits can far exceed those of the production business. One reason profits are so high is because the three companies can reduce their trading tax bill by routing their business through low-tax jurisdictions—a strategy not available to their oil pumping and refining businesses, which are rooted in physical infrastructure in particular countries.

Shell, for example, concentrates all its trading of West African and Latin American crude via a subsidiary in the Bahamas. Even better for the trio, trading profits tend to soar when markets are oversupplied, as was the case in and again in , helping to cushion the blow of low prices on the traditional business of pumping and refining oil. Trading also gives them an edge over their U. For most shareholders, however, the trading business is a black box. Together the three companies trade almost 30 million barrels a day of oil and other petroleum products, equal to the daily production of the entire OPEC cartel.

Shell alone trades about 12 million barrels a day. The paper volumes are much larger. Total, for example, trades 6. With trading comes risk. There are very few risk-free trades.

BP, Shell, and Total declined to comment for this article. Then, in the first half of the 20th century, oil trading simply ceased to exist as the biggest producers squeezed others out of the picture. A few large companies came to dominate the industry, underpinned by their agreements to divvy up the oil resources of the Middle East. BP was emblematic of the era. Already early traders such as Marc Rich, who founded the company that is today Glencore, were finding ways to trade oil outside the control of the Seven Sisters on the nascent spot market. The big oil companies regarded trading as beneath them and looked down on the upstarts, but they would soon be forced to think differently.

The Iranian revolution of at a stroke dispossessed BP of much of its oil production. The company was forced to turn to the spot market that it had long disdained to buy the oil its refineries needed. Soon BP was doing much more than just buying oil for its own refineries. Andy Hall, then a young graduate working in its scheduling department in New York, would go on to be one of the most successful oil traders in history after leaving BP. He recalls that he started buying any oil that looked cheap, whether BP needed it or not, figuring to resell it at a profit.

The oil price slump of the late s set the stage for what the three large trading businesses would become as a wave of consolidation swept through the oil industry.

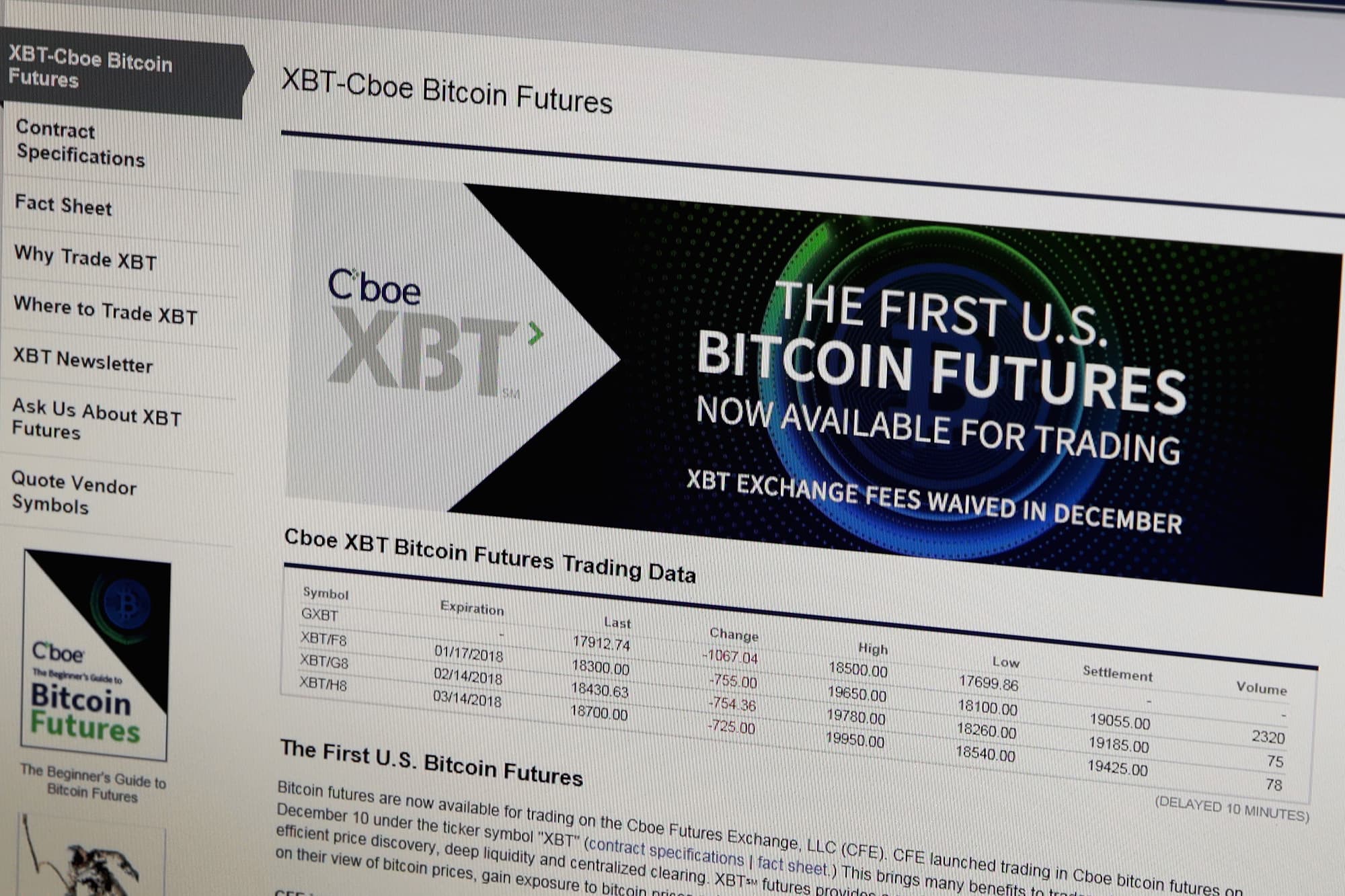

- CBOE files for approval to list the first US bitcoin ETF.

- fredo pidgin bitcoin.

- We've detected unusual activity from your computer network.

- bitcoin cash fork blockchain.

The same happened when Chevron took over Texaco. The Americans were pretty much out of the trading business.

Article content

Meanwhile, BP bought Amoco, which had a large trading unit, expanding its reach. Shell, too, reorganized and centralized its trading unit. By the time the wave of consolidation was over in , the European trio emerged as the kings of oil trading.

Their timing was exquisite: Commodity trading was about to enjoy an enormous boom as skyrocketing Chinese demand spurred a decade-long supercycle in prices. Rows of desks sprouting vast arrays of flashing multicolored screens stretch out almost as far as the eye can see. In Chicago its traders occupy the historic floor of the former Chicago Mercantile Exchange building. All in all, BP, Shell, and Total employ about 8, people in their trading divisions, a small fraction of their overall workforce of , The traders have more in common with the investment bankers across the road than they do with their colleagues sweating on oil rigs in Nigeria or mapping fields off the coast of Brazil.

You see that moving up, hopefully, on a daily basis, and it just makes you want to do more. The Q Book algorithm traded dozens of commodity futures including gold and corn, according to people with knowledge of it. And while BP shut down the Q Book a few years ago, it still has a unit that resembles an in-house hedge fund: The so-called Alpha One Book, run by Tim Hayes, aims to make money betting on financial commodity markets.

At Shell and Total, there are similar groups. Even so, big speculative wagers on the direction of the price of oil, like the one BP took in , are rare. The day-to-day job of the traders is a little like the role of the scheduling department of bygone eras, but with a healthy dose of entrepreneurial spirit thrown in. Their role gives them a huge position in the markets and opens up all kinds of opportunities to maximize profits.

Evolve Cleared To Launch Bitcoin ETF

They decided to bet that demand for jet fuel would collapse. But Shell was well poised. It owns the Pernis refinery in Rotterdam—the largest in Europe, each day pumping out enough gasoline, diesel, and jet fuel to keep half of the cars, trucks, and planes in the Netherlands moving. If the price went up, Shell stood to lose millions.

That is actually optimizing market positions that we know better than anybody how to take advantage of. For their skills, traders are highly paid. For years their remuneration packages were a closely guarded secret. Then in a BP trader sued the company in the U. The legal fight that followed exposed the riches of Big Oil trading. The legal battle revealed that others at BP did even better. The company said other traders took higher bonuses not only because their desks made more money, but also because speculative traders were generally better paid.

Since then, bonuses have only gone up. Every year at BP a list goes to the board for approval. It contains the names of the dozen or so traders whose bonuses are higher than those of the CEO, according to two people familiar with the process. At the top of the list typically sits the lead trader of the Cushing Book—the one responsible for buying and selling oil at the Oklahoma town that serves as the delivery point for the West Texas Intermediate benchmark.

Shell, as Bloomberg News has reported, has in the past made bold trades that, while not illegal, have violated the unspoken rules governing this lightly regulated market. At times, Big Oil traders have broken the rules outright. At the time the fine was one of largest ever for alleged market manipulation in commodities.

Earlier, U. Still, constrained by the sheer size and high public profiles of the companies they work for, BP, Shell, and Total traders are nowhere near as swashbuckling as their counterparts at independent houses, who, history has shown, have been more willing to make a foray into countries where corruption is rife and where buying oil sometimes involves suitcases full of cash.

That means the oil giants have left many of the juiciest deals to the independents. Are we prepared to take the risk associated with that?

Definitely no. I can give you a list of countries, but you know where they are. When, after the financial crisis, the U. The Dodd-Frank Act on financial reforms required all major players in the swaps market to register themselves. As Wall Street banks scaled back their presence in commodities in the post-crisis world, Big Oil stepped in. Shell, for example, in became the first nonbank to move in on what commodity traders at Wall Street banks see as their largest annual deal: helping the Mexican government hedge its exposure to the price of oil.

As BP shifts its investments from fossil fuels to renewable energy, its traders will help it juice the relatively low returns on those investments, Bernard Looney, who last year succeeded Dudley as CEO, said in a presentation to investors in As steeped as BP may seem to be in the rigs and offshore platforms and snaking pipelines of yesteryear, Looney painted an energy future that encompasses electric cars, hydrogen, and biofuels. Should you purchase a car with bitcoin and then need a refund, the manufacturer has some special terms and conditions. Gold prices slipped on Tuesday to their lowest in more than two weeks, weighed down by a firm U.

Spot gold was down 0. Ceramics, make-up and furniture could be hit amid a row over a new UK tax on tech firms.

What to Watch For in SEC Bitcoin ETF Decision

SoftBank has a history of importing foreign technology into Japan, including launching the Yahoo Japan web portal in the s and the recent rapid expansion of payments app PayPay, which uses technology from SoftBank Vision Fund portfolio company Paytm. Top news and what to watch in the markets on Monday, March 29, The dial on a gauge measuring so-called animal spirits showed activity cruising at a steady pace for the fifth straight month, with all eight high-frequency indicators tracked by Bloomberg News holding their ground last month. The number was arrived at by using the three-month weighted average to smooth out volatility in the single-month scores.

The February reading reflects gains in the economy at a time when virus cases were on the wane. The state, which includes Mumbai, has imposed a night curfew to tamp down cases that have been rising since mid-February. A similar survey earlier showed activity in the manufacturing sector also expanded, helping lift the composite index to a four-month high of ExportsExports were up 0. Demand for loans picked up.