Bitcoin Fees. Cash App may charge a fee when you buy or sell bitcoin. You must have a balance of at least bitcoin to make a withdrawal. Transfers to.

Table of contents

- Cash app id verification

- Post navigation

- How to Cash Out Bitcoin: How to Do It Easily

- Using Cash App For Bitcoin

The process takes 30 to 40 minutes. On the Google Play store, it has a 3. This is very comparable to other services like Robinhood and WeBull. Cash App only has limited investing options, but they do allow you to invest in fractional shares - which is a great way to build a portfolio with just a small amount of cash.

Cash app id verification

There is no fee for sending cash using a debit card. Receivers of cash are not charged any fee. You can open an account by visiting their website here. Cash App also uses fraud detection software.

- bitcoin mining difficulty decrease.

- Square's Cash App Now Charging Fees for Bitcoin Purchases - CoinDesk?

- What Do They Offer?.

- Get the Latest from CoinDesk.

- Cash App: Square Crypto Exchange User Review Guide - Master The Crypto!

- bitcoin collateral loan.

- How To Send Bitcoin On Cash App? Learn How To Buy Or Withdraw Bitcoins Easily;

Given its simplicity and the backing of a reputable brand Square , Cash App is worth trying. If you have the need to send cash from a credit card to another person or business, Cash App can certainly perform the task without any issues. You can learn more about him on the About Page , or on his personal site RobertFarrington. He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone wanting to earn more, get out of debt, and start building wealth for the future.

Post navigation

He is also a regular contributor to Forbes. Other Options. Get Out Of Debt.

How To Start. Extra Income. Build Wealth. Credit Tools. Quick Summary. Send and receive money from family and friends No fees for receiving cash Trade stocks and Bitcoin directly on the app. How Do I Open an Account?

- Cash app reload locations.

- accu scooter btc riva;

- GET UP TO $132.

- How Square's Cash App Makes Money.

- cena bitcoina w 2021 roku?

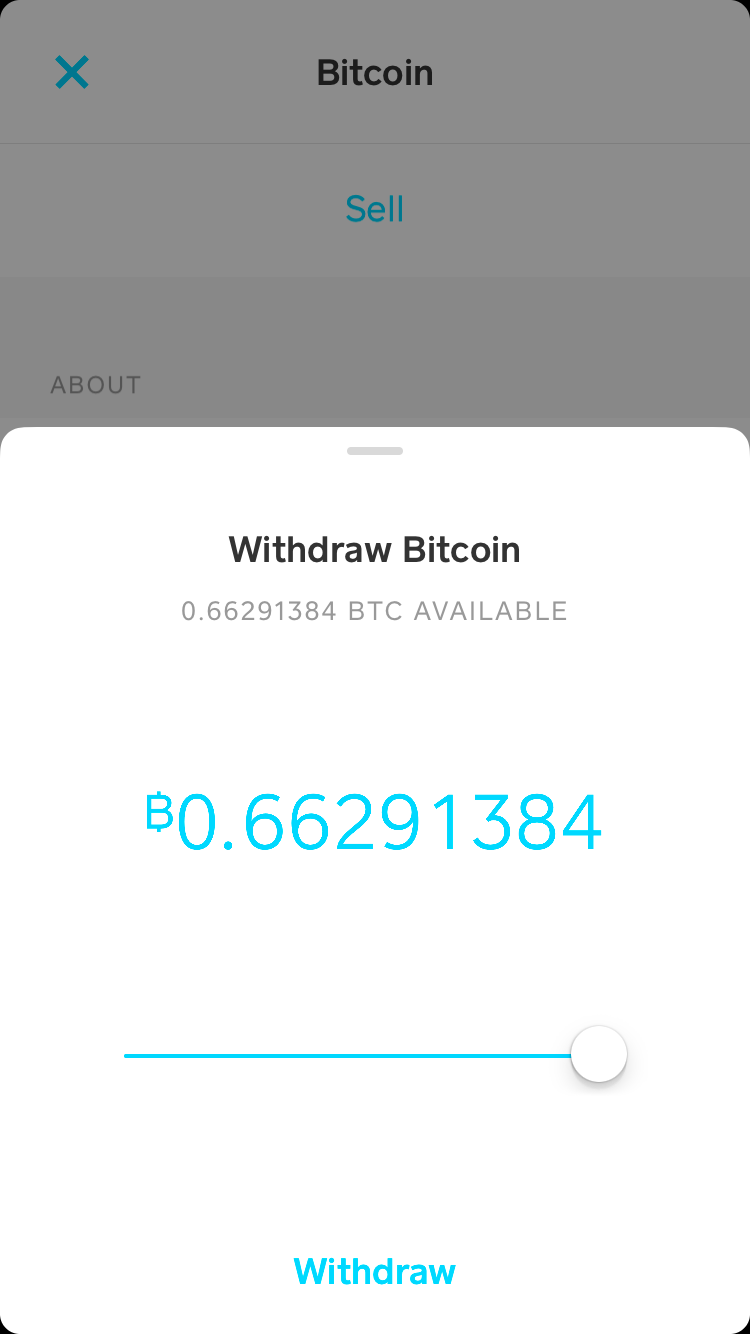

- Sending and Receiving (Depositing and Withdrawing) Bitcoin With Cash App?

- fund tracking bitcoin!

Additionally, you can make direct deposits into your Cash App account. Cash Card and Direct Deposits. Why Cash App vs. Receiving payments on a business account will incur a 1. Cash App Review. Robert Farrington. Connect with. I allow to create an account. While there was no fee for this service when it was first introduced, in late , Cash App began charging users fees of as much as 1.

This is one of Cash App's most profitable services. Cash App factors these differences into the prices it offers its users, thereby generating additional revenue on the exchanges it facilitates. Cash App calculates this price difference based on fluctuations in the value of bitcoin. In an era where smartphones are ubiquitous and consumers are willing to pay for convenience, people are increasingly relying on digital wallets.

Payment-to-payment applications are on the rise, but the competition is intense. In order for Cash App to stand out, it needs to continue to roll out exciting new features that attract new users. Cash App's Cash Boost feature was launched in May ; it features a series of discounts at coffee shops and chain restaurants, like Chipotle and Subway. These instant cashback offers are available exclusively through Cash App's Cash Card. The Boost feature aims to keep users using their Cash Cards often. New "boosts" are announced through social media and are added regularly as Square acquires new partnerships with popular brands.

In January , Square launched a similar free debit card for businesses called Square Card. Some experts predict that Cash App's growth could challenge Paypal's Venmo application in the near future. For now, Cash App's user base stands at 24 million, while Venmo's user base is approximately 40 million.

How to Cash Out Bitcoin: How to Do It Easily

When Square was founded in , it started with a product that gave small businesses the capability to accept credit card payments. From there, the company expanded to create an ecosystem of financial technology products that make it possible to manage a business using exclusively Square products.

With Cash App, Square is attempting to create a similar financial technology ecosystem for individuals. In the future, the Cash App ecosystem could replace a bank account for an individual. In April , Cash App launched in the U. However, the Cash App card is not available in the U. And even though users in both the U. While Square's business-solution products are available internationally in countries such as Canada, Japan, and Australia, the company has not announced when consumers in those countries might gain access to Cash App as well.

The bank, which is named Square Financial Services, will open in It will offer small business loans and "deposit products. The bank will be headquartered in Salt Lake City, Utah. Tech Stocks. Financial Technology. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

Using Cash App For Bitcoin

I Accept Show Purposes. Your Money. Personal Finance. Your Practice. Popular Courses. Company Profiles Startups. Cash App has expanded its functionality beyond just a peer-to-peer payment service; users can also receive direct deposit payments and ACH payments, as well as purchase bitcoin cryptocurrency and trade stocks through the platform.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.