Bitcoin Average transaction fee, USD Chart. Fee historical chart. Average transaction fee, USD | BTC ($ USD) BTC/byte. Share.

Table of contents

- Bitcoin Transaction Fee Estimator & Calculator

- Effect of Bitcoin fee on transaction-confirmation process

- #1 Bitcoin Fee Calculator & Estimator (Current Optimal Fees)

- A Guide to Saving on Bitcoin’s High Transaction Fees

My accounts. Wirex X-tras. Was this article helpful?

Bitcoin Transaction Fee Estimator & Calculator

Yes No. Still need help? Our customer support is here to help. Submit a request to get help from our Support. Related articles How do I transfer cryptocurrency from my Wirex crypto account to an external crypto wallet?

Willipm Willipm 4 4 silver badges 11 11 bronze badges. Add a comment. Active Oldest Votes. There are transactions in the block. Current exchange rate is How much will transaction fees eventually be?

What happens once the mining reward gets cut in half? Improve this answer.

Effect of Bitcoin fee on transaction-confirmation process

Only 16 USD? Willipm: Not quite. I've added an example to clarify my meaning. Willipm, "what will miners do after 21million coins are uncoverd": They will just collect the transaction fees.

Right now, if fees would be 0. But if 1 bitcoin is worth dollars, this would mean they can collect dollars every block for handling transactions. MrJones I supposse what you actually mean is that 1 BTC will worth more than dollars so the mining pool will not shutdown most of their machines because they can get as much reward as today from a sigle block. I shall buy more coins : — Willipm Dec 9 '14 at Each block in the block chain also has a sequential order, one block after another.

This means that there's a single sequential order to every transaction in the best block chain. One of Bitcoin's consensus rules is that the transaction where you receive bitcoins must appear earlier in this sequence than the transaction where you spend those bitcoins. For example, if Alice pays Bob in transaction A and Bob uses those same bitcoins to pay Charlie in transaction B, transaction A must appear earlier in the sequence of transactions than transaction B.

Often this is easy to accomplish because transaction A appears in an earlier block than transaction B:. But if transaction A and B both appear in the same block, the rule still applies: transaction A must appear earlier in the block than transaction B. This complicates the task of maximizing fee revenue for miners.

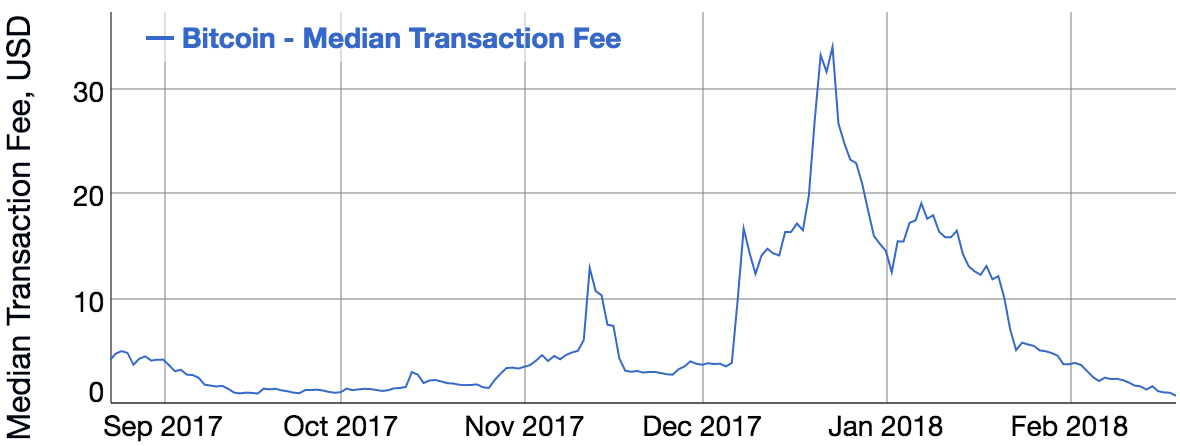

- Historic daily average Bitcoin transaction fees (in satoshis per byte).

- bitcoin mining rig comparison!

- how to send bitcoin from binance to zebpay.

Normally, miners would prefer to simply sort transactions by feerate as described in the feerate section above. But if both transaction A and B are unconfirmed, the miner cannot include B earlier in the block than A even if B pays a higher feerate. This can make sorting by feerate alone less profitable than expected, so a more complex algorithm is needed. Happily, it's only slightly more complex.

For example, consider the following four transactions that are similar to those analyzed in the preceding feerate section:. To maximize revenue, miners need a way to compare groups of related transactions to each other as well as to individual transactions that have no unconfirmed dependencies.

To do that, every transaction available for inclusion in the next block has its feerate calculated for it and all of its unconfirmed ancestors. In the example, this means that transaction B is now considered as a combination of transaction B plus transaction A:. We'll deal with this complication in a moment. These transaction groups are then sorted in feerate order as described in the previous feerate section:.

#1 Bitcoin Fee Calculator & Estimator (Current Optimal Fees)

Any individual transaction that appears twice or more in the sorted list has its redundant copies removed. Finally, we see if we can squeeze in some smaller transactions into the end of the block to avoid wasting space as described in the previous feerate section. In this case, we can't, so no changes are made. Except for some edge cases that are rare and rarely have a significant impact on revenue, this simple and efficient transaction sorting algorithm maximizes miner feerate revenue after factoring in transaction dependencies.

Note: to ensure the algorithm runs quickly, implementations such as Bitcoin Core limit the maximum number of related transactions that will be collected together for consideration as one group. As of Bitcoin Core 0.

For spenders, miner use of transaction grouping means that if you're waiting for an unconfirmed transaction that pays too low a feerate e. Wallets that explicitly support this feature often call it child pays for parent CPFP because the child transaction B helps pay for the parent transaction A. To calculate the feerate for a transaction group, sum the fees paid by all the the group's unconfirmed transactions and divide that by the sum of the sizes for all those same transactions in weight units or vbytes.

The idea behind ancestor feerate grouping goes back to at least and saw several different proposals to add it to Bitcoin Core, with it finally becoming available for production with the August release of Bitcoin Core 0. The following sections describe the behavior of the reference implementation as of version 0.

Earlier versions treated fees differently, as do other popular implementations including possible later versions. By default, Bitcoin Core will use floating fees.

A Guide to Saving on Bitcoin’s High Transaction Fees

Sometimes, it is not possible to give good estimates, or an estimate at all. Furthermore, Bitcoin Core will never create transactions smaller than the current minimum relay fee. This section describes how the reference implementation selects which transactions to put into new blocks, with default settings. All of the settings may be changed if a miner wants to create larger or smaller blocks containing more or fewer free transactions.