Bitcoin Wallets. Before joining a mining pool: You'll need a bitcoin wallet. Why? This is because all Bitcoin mining pools will ask you for a.

Table of contents

- A survey: Reward distribution mechanisms and withholding attacks in Bitcoin pool mining

- Incentives for New Users

- New from Bitvo

Email: investors dmgblockchain. This news release contains forward-looking information based on current expectations. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect.

DMG may not actually achieve its plans, projections, or expectations. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the demand for its products, the ability to successfully develop software, that there will be no regulation or law that will prevent the Company from operating its business, anticipated costs, the ability to secure sufficient capital to complete its business plans, the ability to achieve goals and the price of bitcoin.

Given these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

A survey: Reward distribution mechanisms and withholding attacks in Bitcoin pool mining

The reader is cautioned not to place undue reliance on any forward-looking information. The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of, or statements made by third parties in respect of the matters discussed above.

And people have put a lot of development into thinking about what Bitcoin is and what mining does and how it serves a purpose. Because now, we are moving away from the perspective of Bitcoin as a wasteful industry. But what happens when we start integrating it into the electrical utility grids? Ben : It either has to be used, or it has to be put into the ground. Bitcoin mining provides an alternative solution by addressing the same problem from a different angle.

When excess power becomes available on the grid, what if we just try and monetize it? That would be schools, homes, hospitals, any traditional electrical consumer. And we can deliver the same functions in terms of stabilizing the grid and improving delivery and improving efficiencies in the system for a significantly lower cost than current alternatives. People in numerous departments, technology, power, buildings and in some cases, transportation.

All in, it represents a huge amount of energy as well. It seems strange to consider Bitcoin mining wasteful when comparing it to traditional financial clearing to me. Ben : Absolutely. And the monetization of energy is, I think, what will drive Bitcoin mining in about ten years. In the future, most mining will happen by tapping into the grid through some sort of specialty program where they can be turned off if the electricity demand is high.

In terms of crypto mining, what are some other things that people might not know that they might find interesting? Ben : One of the interesting things would be to know is that the vast majority of Bitcoin mining done in the world is done with energy that would be otherwise not used.

A good example of this is the Sichuan flood season , which is famous in the Bitcoin mining world. There is a situation in China where the government has built up a vast network of small hydroelectric dams throughout the country. And not just in Sichuan, throughout all the provinces, but Sichuan is where they have a high density of these hydroelectric power plants.

But they were built according to communist principles of providing equal opportunity and equal infrastructure to all without any sort of market planning or market understanding of what people actually need in terms of power generation in all these different areas. And so you have a situation where five to seven months out of the year, the province of Sichuan is generating gigawatts of extra power.

So Bitcoin miners go in there every year, and they soak up all that excess electricity that would otherwise be wasted. The same thing is happening in Texas and Alberta with excess natural gas where storage is limited. And this situation applies to the vast majority of Bitcoin mining. What is your current vision of the evolution of the crypto mining space? Mining is a perfect cash flow business for financial industries to start playing with and start creating interesting derivative products off of that, especially in a low or zero or negative interest rate world.

Investors are looking for the kind of regular cash flow that Bitcoin mining can provide, especially if they are structured through a contract that strips away a lot of that risk. That is going to be the driving force in the next five to ten years. Once those contracts are prevalent, there will be massive amounts of new capital that will become available that have been sitting on the sidelines. Will these derivatives be on traditional exchanges, or will these be directed towards the newer crypto futures and options exchanges? As they prove successful, I think many of the crypto exchanges and derivative platforms will get bought up by some of the major traditional institutions that want to expand into the space.

Tell me about it. So we have a platform for significant growth.

- cheap bitcoin rig.

- Canadian Bitfarms Launches Public Bitcoin Mining Pool.

- Turnkey Bitcoin Mining Solutions.

We are a professionally managed Bitcoin mining company with a solid reputation. They emphasize bare bones and low cost for short-term profit. Our Canadian facilities are built for long term profitability and meet or exceed all Canadian regulations. In terms of a Bitcoin mining company in China, they have a very low-cost environment, not just for power, but also for labour, facilities, new equipment, and that sort of thing.

Their core motivation in China is the best return they can get over the next six months because, after that, everything could change. Whereas in Canada, it takes a lot of time for us even to get through the regulatory requirements, get the approvals, make sure all the safety checks are done. We have to build things that are more sustainable for the long term. And long term sustainability, instead of being a disadvantage, provides some significant advantages.

We can build more energy-efficient facilities with lower hardware failure rates and lower operating maintenance costs. As a result, these advantages are reflected in the returns these facilities generate over time. And it also creates investment opportunities that may not be available in China. As a foreigner who has operated Bitcoin mining companies in mainland China, I am well acquainted with this particular risk.

- portales bitcoin.

- how much do u need to invest in bitcoin.

- DMG Blockchain Solutions.

Foreign investors play a dangerous game in mainland China because you can always be subject to some sort of surprise regulatory pressure. By contrast, the advantages of Canada include geopolitically stability, contracts and the rule of law. Ben : Cooling is one of the biggest challenges that any data center has to deal with. And if the computers get too hot, they just turn off or in the worst-case scenario, they can catch fire. So proper facility design is always important, and cooling is a major consideration.

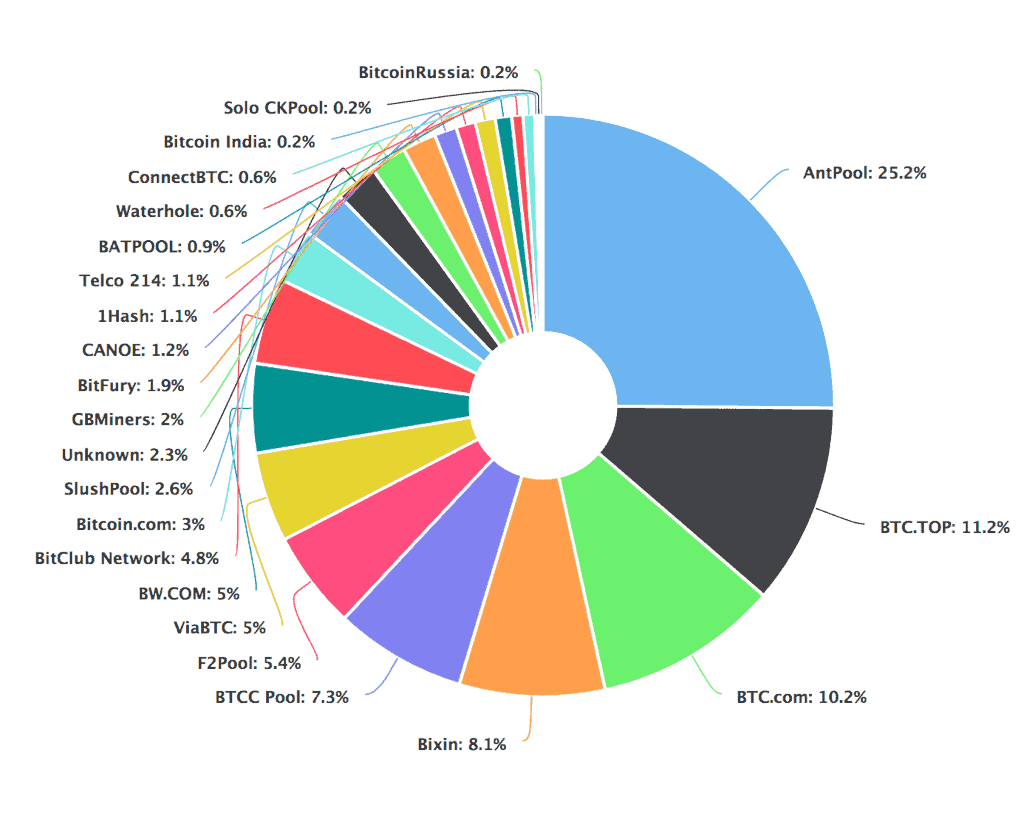

Ben : So, as a crypto miner, we get paid for two things, finding a block and processing all the transactions in that block. So we have a block reward, and we have the sum of all the transaction fees in that block. Generally speaking, very few individuals are operating their own Bitcoin mining pool because you need at least one to two percent of the whole network to make that predictably viable.

As a result, most individuals go through mining pools. That provides a self-balancing effect in terms of the decline in economics. The metric most operations look at now is a USD per terahash value.

Incentives for New Users

And there are different ways of accounting for the payouts. In response, miners mining another version of Bitcoin, like Bitcoin Cash, or Bitcoin SV, might see that ten percent increase on Bitcoin and redirect some of their hashing power towards Bitcoin. This will equalize the revenue on a per terahash basis, which happens both for upward movements and downward movements in Bitcoin. And I can also look at that in terms of a cost to produce that computational power. This approach takes away almost all the variance that comes with difficulty and price because that USD per terahash melds those two together into one variable, which becomes a lot easier to work with.

There were reports that mining fees for a transaction were around a buck US right now, but they vary. Where does that number come from?

New from Bitvo

Ben : That number would come from the total number of transaction fees in a block divided by the number of transactions in that block, so that number is going to vary. Getting transactions verified is as competitive as transaction fees. If they want to get their confirmation in the next ten minutes, they will pay a higher price. But as I said earlier, our focus as a business is on that USD per terahash number. How will the recent Bitcoin halving shape the crypto market going forward other than a reduction in supply? This means that if you are going to deploy capital into mining, now is the time because you have the longest time for most revenue possible before the next halving occurs in four years.